Do you know how financially healthy you are?

Financial Health Scorecard is deployed as an open-source platform for measuring vital signs of an individual’s financial health. The underlying measurement engine is being used for undertaking research across different markets, segments and building data sets for further analysis. The same is offered to institutions/organizations as a tool that can register and use to build their own understanding about their beneficiaries.

Since measurement is the first step to determine one’s financial health, this simple survey tool will help you better understand the different components we have used to formulate this quiz. We are currently in the process of collection of data to help you draw conclusions and further diagnose your financial health.

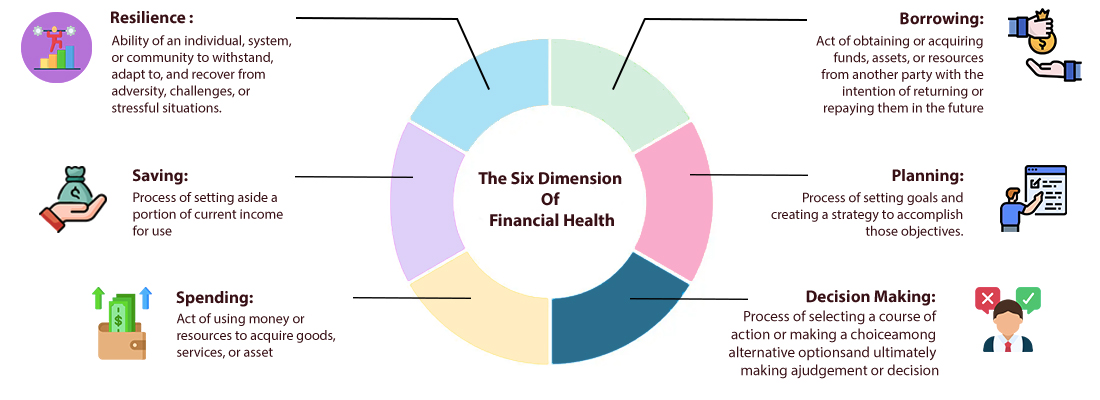

The Six Dimension Of Financial Health in Financial Health Score Card

Let’s check out what is your financial health score

By participating in this anonymous and voluntary survey, you provide you abide by the following:

- The participant is 18 years or older in age.

- Use this data to further finalize the Scorecard.

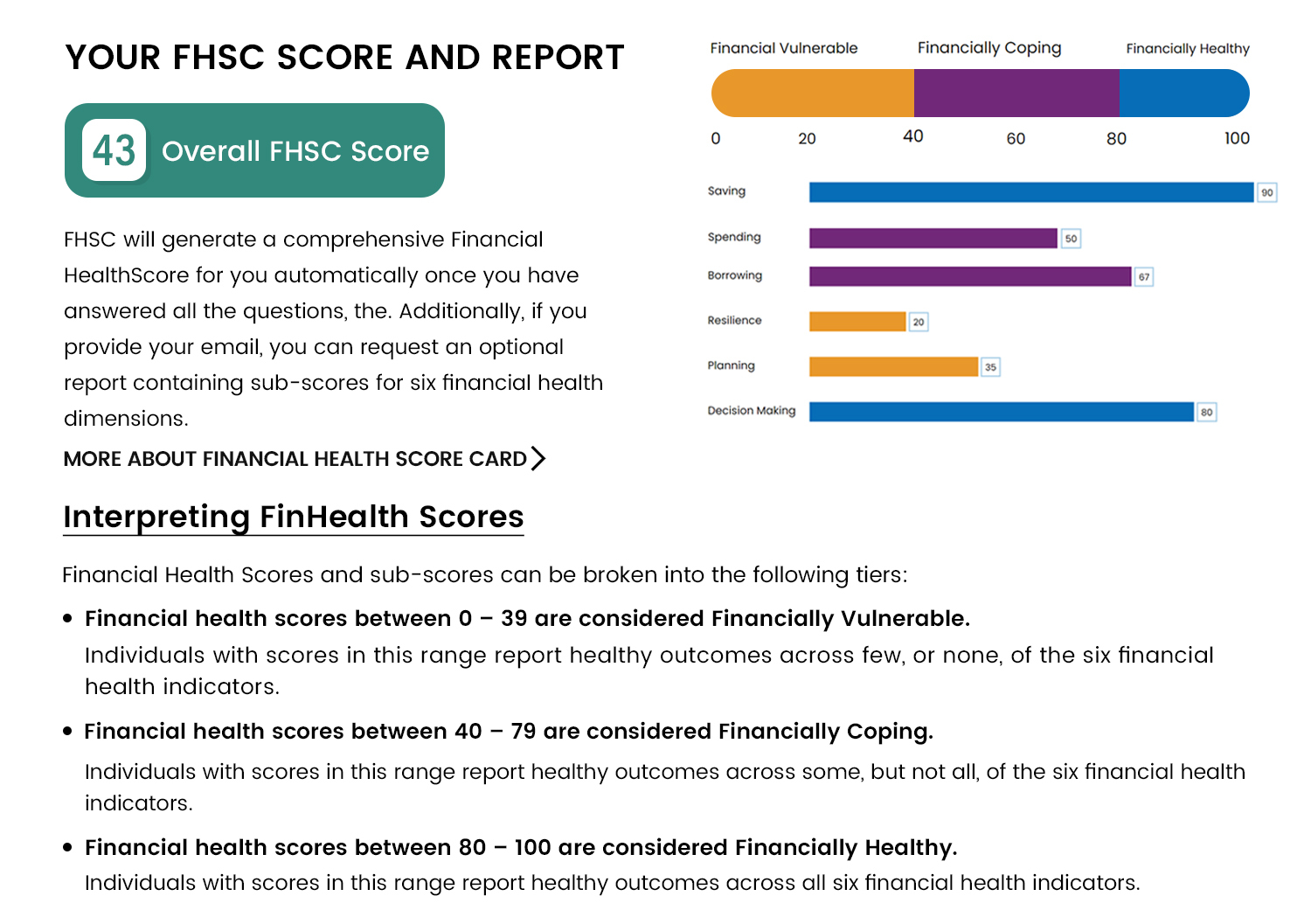

YOUR FHSC SCORE AND REPORT

Saving

Spending

Borrowing

Resilience

Planning

Decision Making

Financial Health Score Card Range:

Financial Vulnerable

Financially Coping

Financially Healthy

0

20

40

60

80

100

Interpreting FinHealth Scores

Financial Health Scores and sub-scores can be broken into the following tiers:

-

Financial health scores between 0 - 39 are considered Financially Vulnerable.

Individuals with scores in this range report healthy outcomes across few, or none, of the six financial health indicators.

-

Financial health scores between 40-79 are considered Financially Coping.

Individuals with scores in this range report healthy outcomes across some, but not all, of the six financial health indicators.

-

Financial health scores between 80-100 are considered Financially Healthy.

Individuals with scores in this range report healthy outcomes across all six financial health indicators.

43

Overall FHSC Score

FHSC will generate a comprehensive Financial Health Score for you automatically once you have answered all the questions, the. Additionally, if you provide your email, you can request an optional report containing sub-scores for six financial health dimensions.

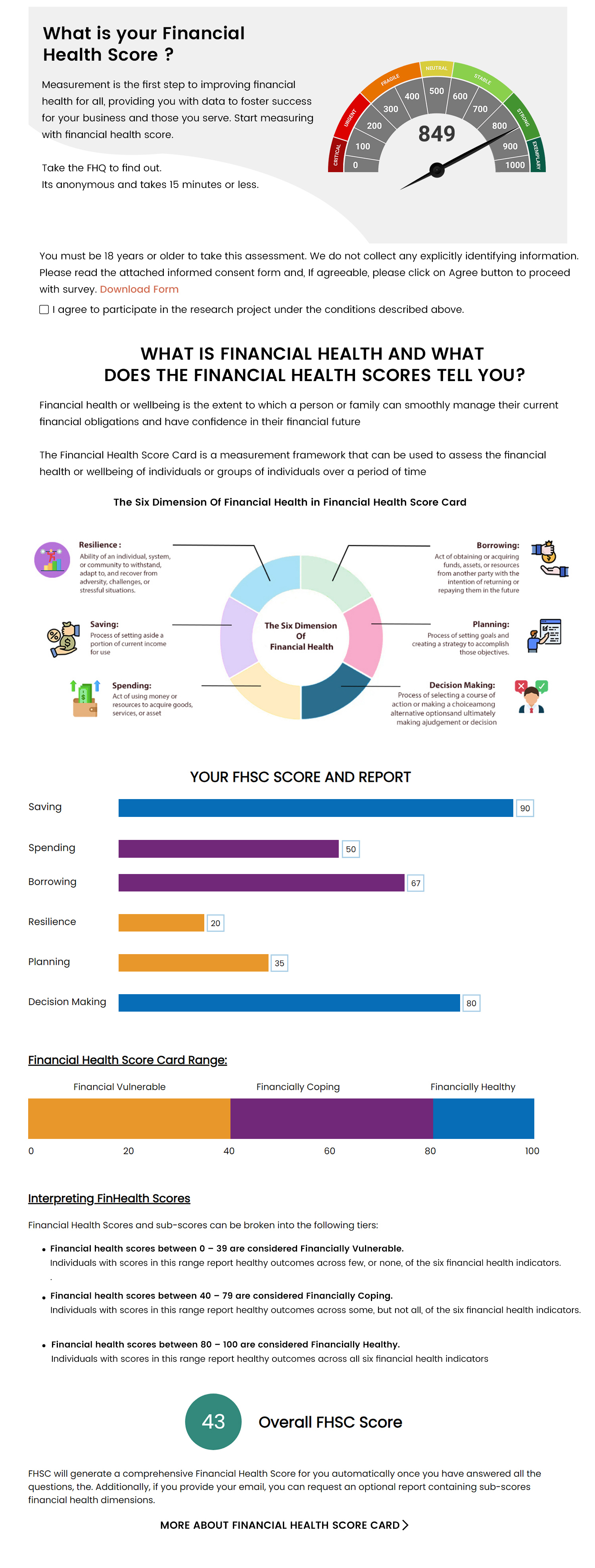

YOUR FHSC SCORE AND REPORT

43

Overall FHSC Score

FHSC will generate a comprehensive Financial Health Score for you automatically once you have answered all the questions, the. Additionally, if you provide your email, you can request an optional report containing sub-scores for six financial health dimensions.

Financial Health Score Card Range:

Financial Vulnerable

Financially Coping

Financially Healthy

0

20

40

60

80

100

YOUR FHSC SCORE AND REPORT

Saving

Spending

Borrowing

Resilience

Planning

Decision Making

Interpreting FinHealth Scores

Financial Health Scores and sub-scores can be broken into the following tiers:

-

Financial health scores between 0 - 39 are considered Financially Vulnerable.

Individuals with scores in this range report healthy outcomes across few, or none, of the six financial health indicators.

-

Financial health scores between 40-79 are considered Financially Coping.

Individuals with scores in this range report healthy outcomes across some, but not all, of the six financial health indicators.

-

Financial health scores between 80-100 are considered Financially Healthy.

Individuals with scores in this range report healthy outcomes across all six financial health indicators.